Loopholes, Liberty, and Judge Learned Hand

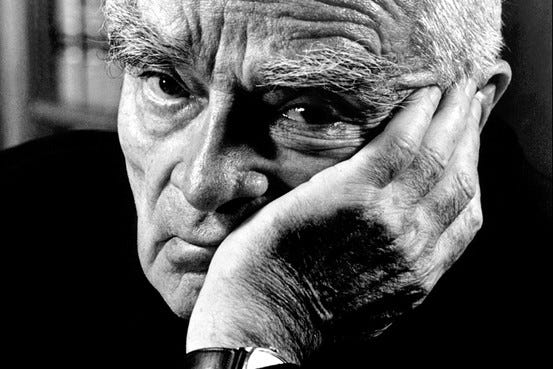

If you’ve been around seasoned tax educators, you’ve probably heard them quote Judge Learned Hand. There’s a reason his words echo through tax seminars and courtrooms alike: his writing reshaped how we think about tax planning, substance over form, and the boundaries of government power.

Although he never made it to the Supreme Court, Hand was one of the most influential jurists of the 20th century. His appellate opinions were so persuasive that the Supreme Court often adopted them outright. Over more than 50 years on the federal bench, he left behind a body of work that still guides the way we practice tax today.

Let’s dig into what made his thinking so important, and why it still matters in 2025.

Who Was Learned Hand?

Billings Learned (pronounced LURN-id) Hand was appointed to the federal bench by President Taft in 1909. He served until his death in 1961. Despite never ascending to the Supreme Court, he earned the nickname “The Tenth Justice” because of how often his reasoning influenced the justices.

What made him stand out was his mix of practicality, restraint, and a deep respect for liberty. He didn’t try to legislate from the bench, and he had no use for legal drama. He wanted to get the law right—and to explain it clearly.

His Tax Legacy: It’s Not About Patriotism. It’s About Legality.

Hand was one of the first judges to state clearly that tax planning isn’t a moral failing—it’s a legal right. In Helvering v. Gregory, 69 F.2d 809 (2d Cir. 1934), he wrote:

“Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes.”

That quote gets repeated at tax seminars all the time, but it’s more than just clever phrasing. It’s a core legal principle: if a taxpayer follows the law, courts shouldn’t add obligations that don’t exist. But Hand also made it clear: not every scheme gets a free pass. He believed in drawing a line between legitimate planning and abuse.

Gregory v. Helvering: The Blueprint for Substance Over Form

A taxpayer tried to exploit the corporate reorganization rules to avoid dividend taxes. The transaction technically followed the statute, but it had no real business purpose. Hand saw through it. When the case reached the Supreme Court in 1935, the justices agreed, calling it:

“A mere device which put on the form of a corporate reorganization as a disguise for concealing its real character.”

Hand had already ruled that the transaction didn’t qualify as a legitimate reorganization because it lacked economic substance. The Supreme Court’s affirmation laid the groundwork for the substance-over-form doctrine we still apply today.

This wasn’t just about shutting down aggressive planning, it was about making the tax system intelligible and fair, not a game of loophole whack-a-mole.

Form, Substance, and Reasonable Boundaries

Hand walked a careful line. He wasn’t interested in punishing taxpayers for smart planning. He just believed that when you go too far, when your transaction is only about avoiding tax without any other meaningful purpose, it’s not going to hold up.

Here’s how his thinking shaped tax doctrine:

The “Appreciable Effect” Test (Gilbert v. Commissioner)

In a later case, Hand wrote a dissent that tried to add clarity:

“When the petitioners decided to make their advances in the form of debts… did they suppose that the difference would appreciably affect their beneficial interests in the venture, other than taxwise?”

Translation: If you’re choosing a structure solely for tax benefits, and it doesn’t really change your economics, it probably won’t pass muster.

Respecting Entities

Hand said corporations should be respected if they’re doing actual business, even if they’re tax-motivated.The Realization Principle

You don’t trigger income just because something could happen (like delaying a foreclosure).No After-the-Fact Rewrites

He rejected the idea that the IRS could redefine assets or intentions just because they didn’t like the result.

Hand’s approach? Stick to the law, apply it evenly, and don’t let either side—taxpayer or government—invent new rules mid-game.

Hand’s Other Contributions (That We Shouldn’t Ignore)

While his tax opinions made him famous in our circles, his legal mind reached far beyond tax:

Free Speech

In Masses Publishing Co. v. Patten (1917), he struck down wartime censorship before the Supreme Court was ready to. His logic later showed up in Brandenburg v. Ohio.Censorship

He ruled that James Joyce’s Ulysses wasn’t obscene—paving the way for greater literary freedom.Tort Law

He created the famous “Hand Formula” for negligence:

B < P × L

(Where B = burden, P = probability of harm, L = severity).Judicial Restraint

He warned against judicial activism, saying courts are a “necessary but dangerous branch.” He wanted courts to apply the law, not rewrite it.Fun Fact

In 1942, he recorded a Civil War folk song for the Library of Congress. Because apparently even judges need a creative outlet. You can listen here: Judge Learned Hand Sings The Iron Merrimac.

Why Learned Hand Still Matters

In a world of “influencers” pushing hyper-aggressive tax positions, overly literal interpretations, and an ever-complex tax code, Judge Hand gives us a way to make sense of it all.

He reminds us:

Good planning is not a sin. (I do wonder what Judge Hand would think about social media influencers and some of their assinine tax advice.)

The form of a transaction matters, but substance matters more.

Judges and tax professionals alike need to approach the law with humility and clarity.

The Spirit of Liberty, Then and Now

This quote should give us pause and is worthy of a few moments of reflection:

“What do we mean when we say that first of all we seek liberty? I often wonder whether we do not rest our hopes too much upon constitutions, upon laws and upon courts. These are false hopes; believe me, these are false hopes. Liberty lies in the hearts of men and women; when it dies there, no constitution, no law, no court can save it. No constitution, no law, no court can even do much to help it. While it lies there, it needs no constitution, no law, no court to save it.”

— Judge Learned Hand, The Spirit of Liberty, 1944

Judge Hand gave that speech in the middle of World War II, with democracy under siege abroad and deep division at home. And yet his message wasn’t one of despair, it was a call to personal responsibility. A reminder that freedom and fairness begin with how we treat each other, how we interpret the law, and how we carry ourselves as professionals and citizens.

Today, as our nation navigates political division, distrust in institutions, and a legal system stretched by partisanship and complexity, Hand’s words hit home. The law can only do so much. The spirit behind the law: honesty, humility, and shared purpose, what keeps the system alive.

For those of us who work in tax, who interpret the law daily and guide others through it, Judge Hand’s legacy is a reminder that our role is more than compliance. We don’t just follow the rules. We help preserve the trust that gives the rules meaning.

May we carry forward that spirit, in tax practice and in life, knowing that liberty, like the law, only survives when people choose to uphold it.